"It is important to remember that financial literacy, like all transition activities, should be started early as an ongoing process rather than waiting until the child is 'transition age' which is usually considered around age 14-16 in schools."

STRONG FRAMEWORK: Schools can help teach financial literacy, with a particular emphasis during transition. Students can learn real life examples though structured learning experiences and community based instruction.

FINANCIAL LITERACY FOR STUDENTS WITH DISABILITIES

A Necessary Life Skill for Independent Living

S tudents with disabilities need to have financial literacy as part of their transition to adult life. This will enable them to live more independently. The Arc has launched a Center on Financial Literacy to help address this need (see Resources, next page) Some key considerations are:

• The individual with a disability is part of the planning team.

• The student thinks about where s/he wants to live and work, both of which impact finances (costs and income).

• Some people with disabilities may need supports for financial decisionmaking and to gain financial literacy.

• There must be consideration of which benefits such as SSI, Medicaid, and work incentives would be helpful, as well as whether if any assets that might jeopardize these benefits could be in an ABLE account or special needs trust. Independence, The National Resources for Access, Self-Advocacy and Employment (RAISE) Technical Assistance Center held a webinar, "Developing Financial Capability Among Youth." Research shows that students who had higher financial responsibility had better outcomes in employment and self-sufficiency. Students need to learn concepts about:

• earning; gross vs. net income

• saving; having a safety net

• protecting against identity theft

• spending; cash, check, debit and credit cards

• borrowing; loans and credit cards

Other related concepts include understanding insurance, disability benefits, credit ratings, creating a budget, price comparison, and avoiding scams. Schools can help teach financial literacy, with a particular emphasis during transition. Students can learn real life examples though structured learning experiences and community based instruction. The Center for Parent Information and Resources has a tip sheet which emphasizes the importance of starting early and linking financial literacy to IEPs. Centers for Independent Living also help students with independent living skills, including money management start ing with something as basic as making change for bus fare. Families can also help reinforce all of these concepts at home. Begin by including the student with a disability in everyday conversations. For example, show them a shopping list, how much is in the food budget, and head to the grocery store to compare prices, use coupons or sales, and add up on a calculator as you go. Parents can also show their son/daughter how to save up for an item and also decide if something is really needed or just what they want in the moment. The Council for Economics Education has two parent handbooks, "Financial Fitness for Life," which are free e-books for grades K-5 and 6-12 available in English and Spanish at econedlink.org/afterschool/parent-resources.php. There are sample activities for children as well as lists of topical children's books.

It is important to remember that financial literacy, like all transition activities, should be started early as an ongoing process rather than waiting until the child is "transition age" which is usually considered around age 14-16 in schools. Students who have financial capability increase their chances of independent living.•

ABOUT THE AUTHOR: Lauren Agoratus, M.A. is the parent of a child with multiple disabilities who serves as the Coordinator for Family Voices-NJ and as the central/southern coordinator in her state's Family-to-Family Health Information Center, both housed at SPAN, found at spanadvocacy.org

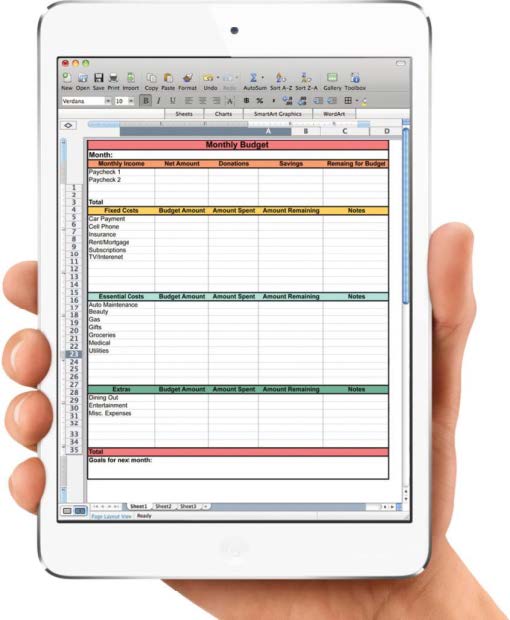

MOVING IN THE RIGHT DIRECTION: Research shows that students who had higher financial responsibility had better outcomes in employment and self-sufficiency. (Left) Students need to learn concepts about earning, saving, spending, and budgeting.