Critical accounting estimates

Our response and significant findings

- The total allowance for doubtful accounts is comprised of trade and other receivables (2019 - $2.3 million; 2018 - $2.2 million), property taxes and payments in lieu of taxes (2019 - $1.3 million; 2018 - $1 million) and vacancy and charity rebates (2019 - $1.9 million; 2018 - $1.9 million).

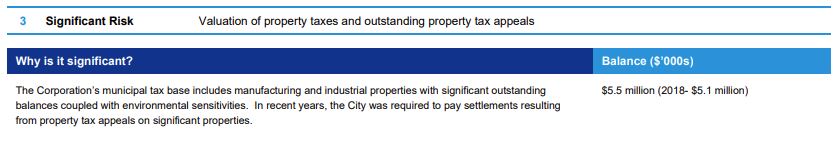

- Net property tax reductions resulting from settlement on certain property tax appeals and other adjustments during the year amounted to $7.2 million (2018 – $6.6 million).

- The Corporation’s tax appeals reserve of $11.4 million (2018 - $7.4 million) can be utilized if required, to mitigate risk associated with uncertainties that exist surrounding future property tax adjustments.

- Additionally, the Corporation has available certain reserve funds to further mitigate its credit risk. The working capital reserve fund has a balance available of $24.5 million (2018 - $21.2 million) and the budget stabilization reserve fund has a balance available of $9.0 million (2018 - $7.3 million) as at December 31, 2019.

- We reviewed Administration’s analysis for the allowance for doubtful accounts at December 31, 2019.

- We performed subsequent receipts testing on trade and other receivables.

- We reviewed the status of significant aged and “at risk” receivables.

- We considered subsequent events which have provided additional information and evidence on the net realizable value of accounts receivable.

- We concur with the reasonableness of the Corporation’s allowance for doubtful accounts at December 31, 2019.