Critical accounting estimates

Our response and significant findings

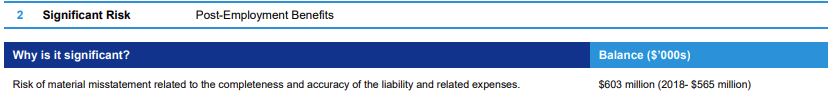

The liability for employee future benefits recognized on the consolidated statement of financial position at December 31, 2019 is comprised of accrued post-employment and post-retirement benefits, such as health, dental, life insurance and long-term disability, accrual for Workplace Safety and Insurance costs (“WSIB”) given that the Corporation is a schedule 2 employer and must finance its own costs, vacation and vested overtime liability and accrued vested sick leave (see note 6 to the consolidated financial statements for more details).

The most recent valuation of the Corporation’s post-retirement benefit and sick leave gratuity plans by the Corporation’s actuary, Actuarial Solutions Inc., was performed as at August 1, 2019. An extrapolation of the December 31, 2019 fiscal year benefit expense was performed by the actuaries.

The accrued benefit obligation for post-retirement and post-employment benefits, representing the present value of the cost of these benefits earned and funded in future periods amounted to $591 million (2018 - $585 million). Unamortized net actuarial losses representing the difference between the accrued benefit obligation and the liability amounted to $69 million (2018 - $90 million). These actuarial losses represent changes in the value of the accrued benefit obligation due to differences in the Plan’s experience compared to expectation (i.e. changes in claims costs) and changes in actuarial assumptions (i.e. change in the discount rate) incorporated in the underlying calculations. These changes are amortized into the liability recognized on the consolidated statement of financial position over the estimated remaining service life of the respective employee groups or 13.3 years.

The liability for employee future benefits is unfunded. Benefits are funded on a pay-as-you-go basis. As a result, the Accumulated Surplus, disclosed in detail in note 8 (a) to the consolidated financial statements, includes disclosure of the amounts to be recovered in future years relating to the Corporation’s liability for future employee benefits.

KPMG evaluated the reasonableness of the discount rate used in the current year calculation. The discount rate used by the Corporation was 2.90% at December 31, 2019 and 3.55% at December 31, 2018. The discount rates used are consistent with those used by other public sector entities.

WSIB provides a statement to enable the Corporation to record its unfunded liability relating to WSIB. It is noted that in future years, the statement provided by WSIB will not support audit evidence. It would be appropriate to obtain an actuarial valuation on the Corporation’s WSIB liability in 2020.

KPMG performed audit procedures on the underlying data that was used as the basis for calculating the accrued benefit obligation and found the data to be accurate and complete.