Year ended December 31, 2019

16. Income taxes (provision for payment in lieu of corporate taxes) (continued):

The provision for income taxes varies from amounts which would be computed by applying the

Corporation’s combined statutory income tax rate as follows:

| 2019 | 2018 | |

|---|---|---|

| Basic rate applied to total comprehensive income | ||

| before income tax | 26.50% | 26.50% |

| Change in income tax resulting from: | ||

| Items not deductible for tax purposes and other | (3.64%) | (0.09%) |

| Effective rate applied to comprehensive | ||

| income before income taxes | 22.86% | 26.41% |

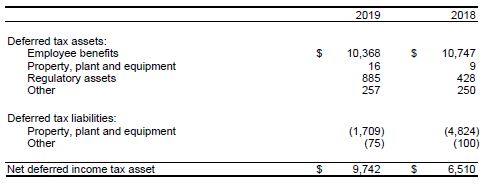

The components of the deferred income tax assets and liabilities are summarized as follows:

At December 31, 2019, a deferred tax asset of $9,742 (2018 - $6,510) has been recorded. The utilization of this tax asset is dependent on future taxable income in excess of income arising from the reversal of existing taxable temporary differences. The Corporation believes that this asset should be recognized as it will be recovered through future rates.