14. Employee future benefits:

EWU pays certain health, dental and life insurance benefits on behalf of its retired employees. Significant assumptions underlying the actuarial valuation include management's best estimate of the interest (discount) rate, mortality decrement, the average retirement age of employees, employee turnover and expected health and dental care costs.

The Plan was amended such that all active Commission management and union employees covered under the Commission collective agreement from July 1, 2012, would be included as part of the Plan and have their coverage sponsored by EWU. The December 31, 2012 date was chosen to reflect this event in the Plan. Reference Note 1 for further information.

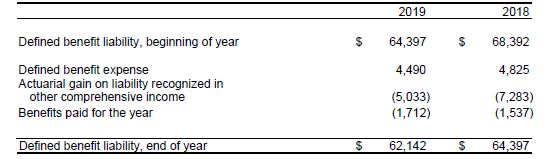

EWU measures its accrued benefit liability for accounting purposes as at December 31 each year. A valuation date of December 31, 2019 has been used to calculate the current obligation. EWU's employee future benefit liability consists of the following:

| 2019 | 2018 | |

|---|---|---|

| Defined benefit liability | $ 62,142 | $ 64,397 |

| Defined benefit liability, end of year | $ 62,142 | $ 64,397 |

Information about EWU's unfunded defined benefit plan is as follows:

Changes in the present value of the defined benefit liability: