Heritage Funding Source: https://www.citywindsor.ca/residents/planning/Plans-and-

Heritage Funding Source: https://www.citywindsor.ca/residents/planning/Plans-and-

Community-Information/Know-Your-Community/Heritage-Planning/Heritage-Property-

Incentive-Programs/Pages/default.aspx

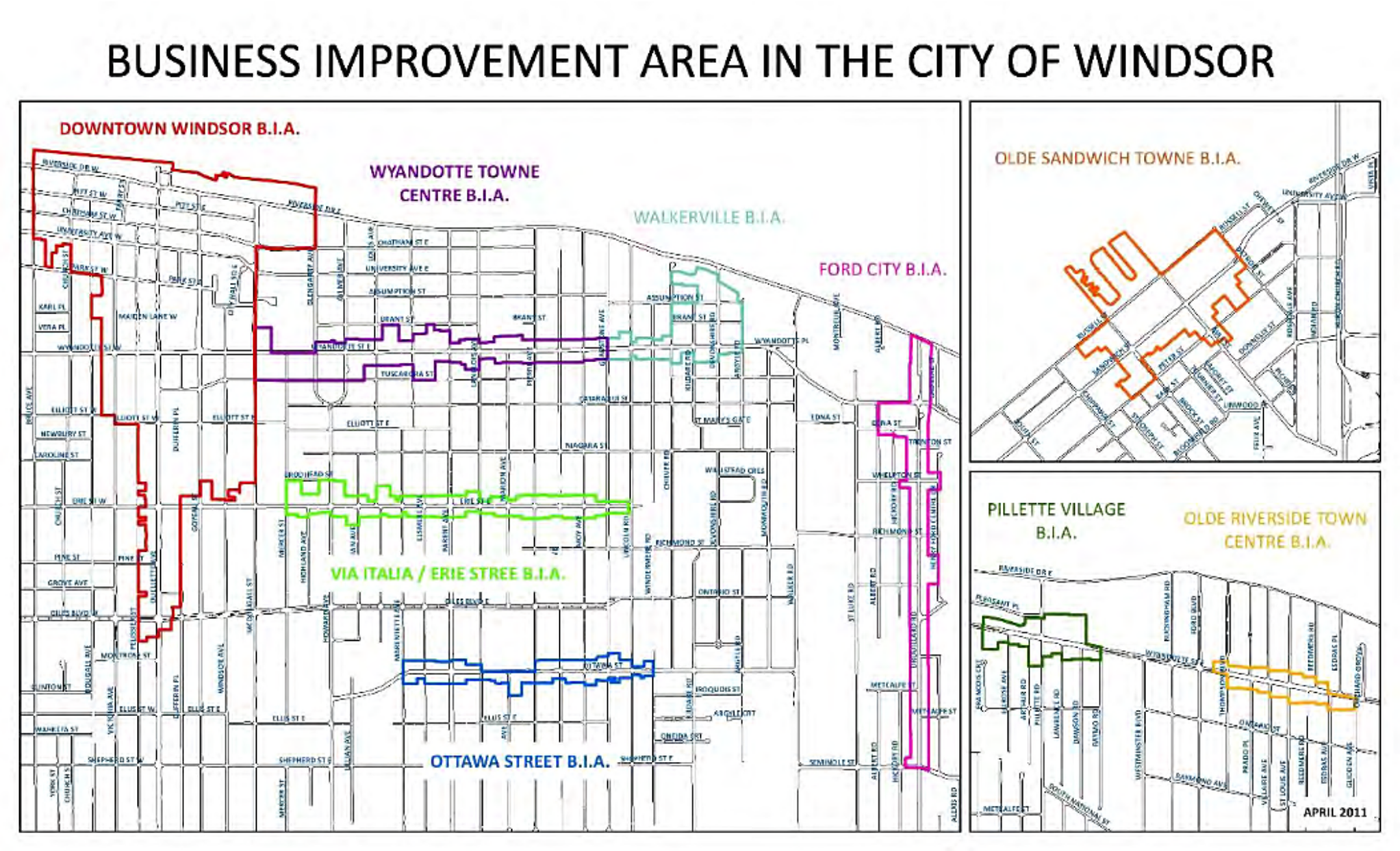

Business Improvement Areas (BIA)

Figure 1: Map of Business Improvement Area Boundaries within the City of Windsor

Source: https://citywindsor.ca/residents/planning/development- incentives/Documents/BIA%20MAPS.pdf

Tax Billing Cycle

The tax billing cycle spreads 50% of the previous year’s taxes over three installments over the year (refer to the source below for the exact dates). Supplementary (additional) bills may apply if new additions were added to the original building. Tax is calculated based on the MPAC (Municipal Property Assessment Corporation) assessment rolls in which the tax incorporates both municipal and educational purpose levies. These bills are billed to a maximum of two times in the latter half of the year. Furthermore, local improvement charges are included in the annual charges and are made known to the property owner.

Source: https://citywindsor.ca/cityhall/Taxes--and-Assessment-/Pages/Tax-Billing-Cycle.aspx