insurance policy (which include City fleet, police fleet, and transit fleet) are investigated and defended by the insurer, at the insurer’s cost. The City’s $100,000 auto deductible only applies in the event of a settlement. This means that the City pays less in external adjusting fees and legal defence fees. Lastly, in 2015, Risk Management implemented a Risk Reporting program where it meets semi-annually with operating departments to go over identified claims risks and mitigation strategies. Administration as a whole has become more risk aware, and as a result, certain claims are mitigated or defended more effectively.

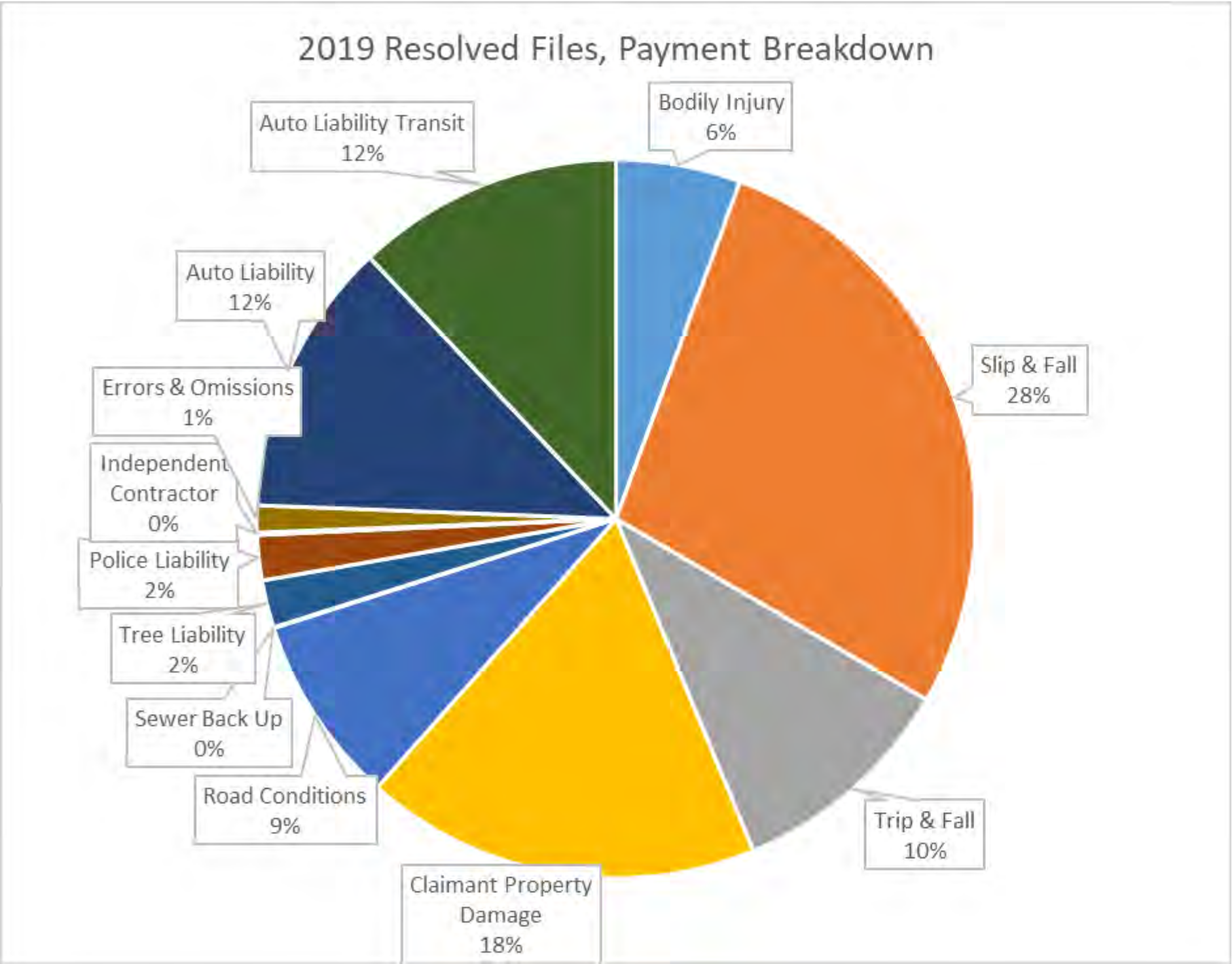

In examining the files that closed in 2019, the Claim costs were distributed as follows:

Most of the Claim costs can be attributed to slip and falls on City property (primarily roads and sidewalks). The breakdown by payment category varies from last year, the most significant changes being that claimant property damage increased from 5% to 18%, auto liability increased from 0% to 12%, and trip and falls went from 29% down to 10%. The large increase in Claimant Property Damage payouts is attributable to one significantly large settlement of a longstanding matter. Likewise, there were two large auto settlements that drove that percentage upwards. With regard to trip and falls, the City is taking a stronger stance on defending them since the City implemented improvements in its sidewalk inspection program. With more a more defendable program, the City can leverage arguments in its favour to negotiate better settlements, or deny the claims outright.