categories. Of the 21 claims, 7 relate to bicycle related injuries occurring on roads or trails, and the majority of those claims allege that the injuries were as a result of uneven riding surface.

The remaining categories were unremarkable, and fell in line with historical averages.

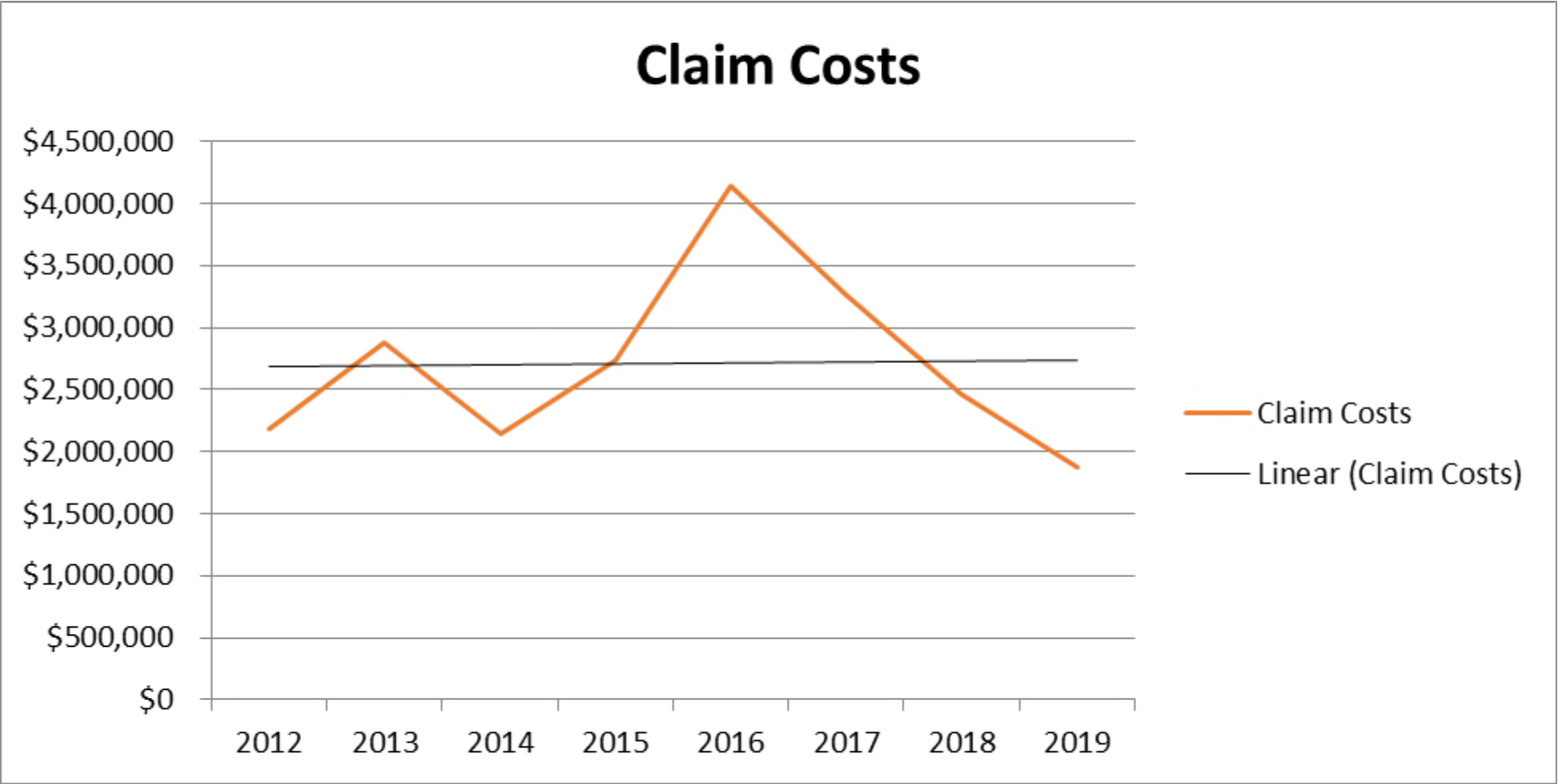

A. Claim Costs

Claim costs typically include third party claim settlements, external adjusting fees, external legal fees, and all other costs incurred as part of the investigation and defence of a Claim. The chart below shows the Claims costs paid by the City since 2012. On average, claim costs have been steady, but the variation in claims costs over the years has been significant. Claims costs for 2019 were $2,098,902, the lowest the City has seen in at least 8 years.

In 2010, the City increased its insurance deductible for general liability insurance from $25,000 to $250,000. Typically, a larger claim results in litigation, and takes around two years or longer from the date of loss before it resolves. That means that the impact of moving to a higher deductible was not truly seen until 2012, two years after the change. Because of the general two year lag, there is a correlation between claim payments and weather conditions from two years prior. For example, in 2012, Windsor experienced a very mild winter, which resulted in low claims costs incurred in 2014. In 2013 and 2014, Windsor experienced a very severe winter, which resulted in significant claims costs in 2016.

The downward trend that the City has experienced since 2016 can be attributed to a combination of factors. It remains true that the number of claims and their severity are weather dependent and the past few winters have not been as severe as the 2013/2014 winter. In addition, there are savings due to the structure of the City’s current insurance program. In 2017, the City’s insurance portfolio moved to Jardine Lloyd Thompson (“JLT” and now Marsh). As part of that program, all claims falling under the City’s auto