24. Financial instruments and risk management (continued):

(i) Credit risk (continued):

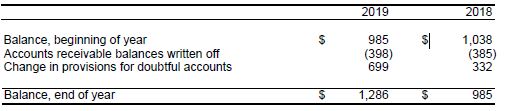

The carrying amount of accounts receivable is reduced through the use of an allowance for impairment and the amount of the related impairment loss is recognized in the consolidated statement of income. Subsequent recoveries of receivables previously provisioned are credited to the consolidated statement of income. The balance of the allowance for impairment at December 31, 2019 was $1,286 (2018 - $985).

A continuity of the allowance for doubtful accounts is as follows:

The Corporation's credit risk associated with accounts receivable is primarily related to payments from distribution customers. At December 31, 2019, approximately $3,090 (2018 - $2,696) is considered 60 days past due. Credit risk is managed through collection of security deposits from customers in accordance with OEB regulation. As of December 31, 2019, the Corporation holds security deposits in the amount of $4,191 (2018 - $5,114).

(ii) Liquidity risk:

Liquidity risk is the risk that the Corporation will not be able to meet its obligations associated with financial liabilities. The Corporation monitors its liquidity risk to ensure access to sufficient funds to meet operational and investing requirements. The Corporation's objective is to ensure that sufficient liquidity is on hand to meet obligations as they fall due while minimizing interest expense. The Corporation has access to a line of credit and monitors cash balances to ensure that sufficient levels of liquidity are on hand to meet financial commitments as they come due.