FINANCIAL RESULTS

debenture were loaned to WUC, which pays its share of the annual interest costs to WCU, and has provided a guarantee to WCU in support of its ultimate repayment of these funds, reducing the overall exposure of WCU on this debt. This balance is not due until 2042, and funds are currently being set aside in a sinking fund to facilitate repayment.

Current liabilities increased by $3.2 million, primarily as a result of an increase in deferred revenue. Funding from the IESO for use in conservation activities, received at the end of 2019, and not yet utilized, resulting in a higher deferred tax balance and also a higher cash balance, as described previously.

The decrease in other non-current liabilities is primarily a result of actuarial revaluations on the employee future benefits liability, which decreased from $68.4 million to $64.4 million. The employee future benefits liability is sensitive to interest rate changes and is expected to be volatile over the next several years.

operatinG activitieS

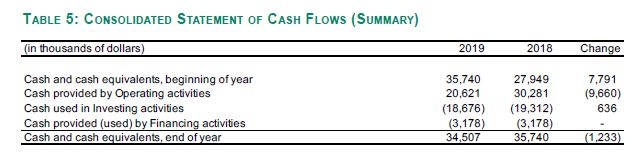

Cash increased during the year as a result of continued strong operating performance.

inveStinG activitieS

Cash used in investing activities was $19.5 million compared to $19.3 million in the prior year. Investing activities include $19.6 million of capital expenditures, versus $15.6 million in 2018, offset by contributed

capital expenditures targeting system renewal, technological advances and accommodating new customer growth. During the year the company also invested further in its sinking fund and short term GIC's in the amount of $2.2 million.

financinG activitieS

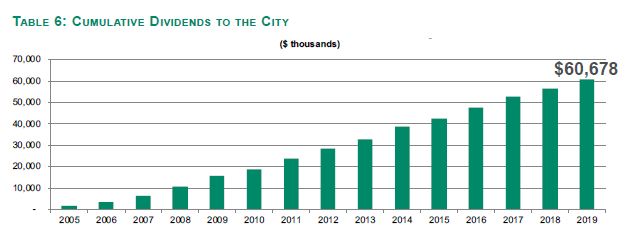

Financing activities include dividends paid to the City of Windsor along with changes in related party balances. The dividend payment to the City of Windsor of $4 million is in accordance with the target set for 2019.

The company has paid cumulative dividends to the City of Windsor since 2005 of $60.7 million.