Insurance Premiums

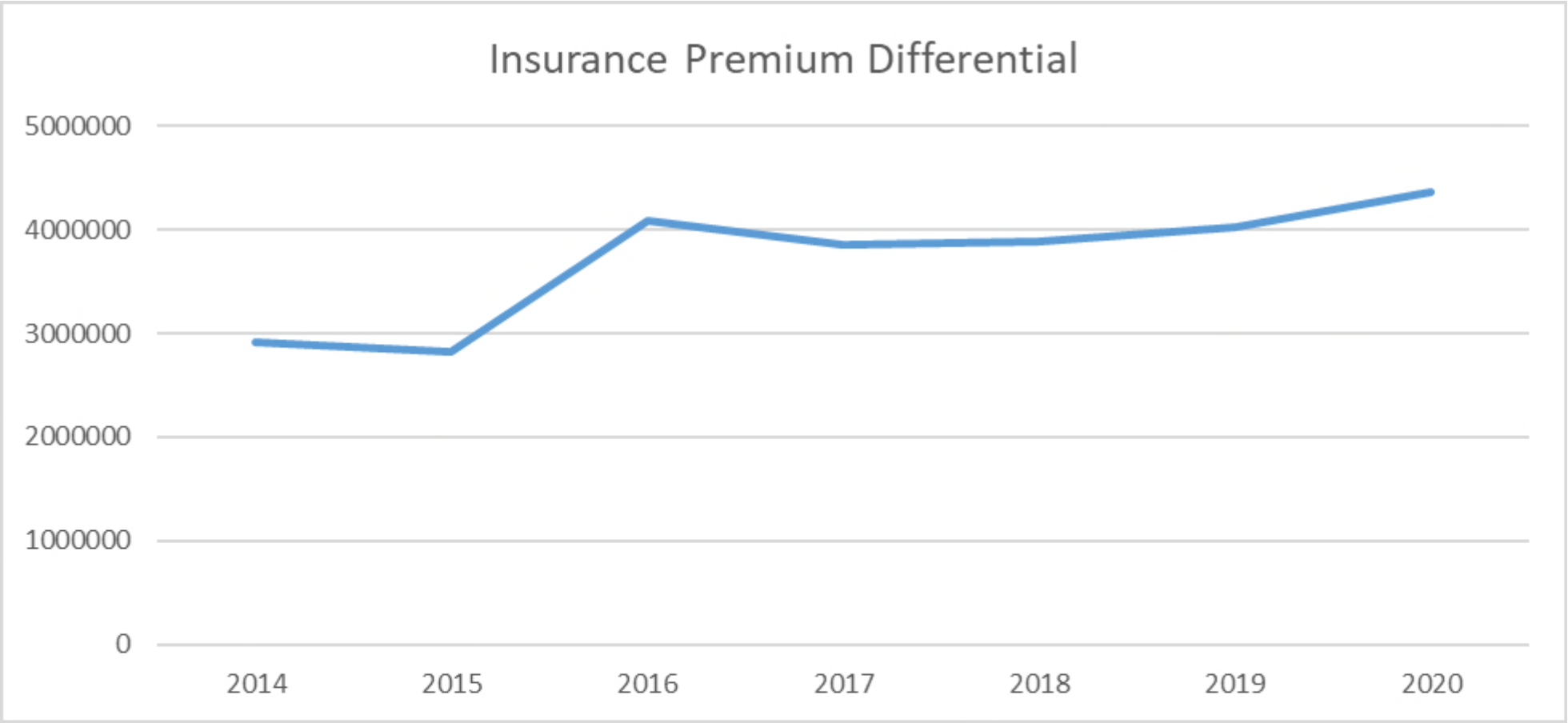

In 2016, the City issued an RFP for insurance and Jardine Lloyd Thompson (JLT) took over the City’s insurance program effective January 1, 2017. Premiums for 2018 were $4,019,976.74 (incl. taxes) and premiums for 2019 have come in at $4,367,231.88 (incl. taxes). This represents an overall increase of 8.64%. However, part of this increase is due to an additional line of insurance purchased in 2019 and approved by the 2019 budget, but which was billed in 2020. Removing this additional line of insurance, the rate increase is closer to 6%.

The insurance industry is in what is referred to as a “hard market”. A hard market is when there is a high demand for insurance and reduced supply. During a hard market, insurance rates go up industry-wide. For 2020, the City experienced an increase to its property rates and auto rates. This had more to do with market conditions than the City’s individual claims history. In addition to premium rate changes, premiums also fluctuate based on increase in property values, and the number of vehicles and properties acquired or disposed.

Future rate increases depend on claims experience and the general insurance market. Claims that exceed the City’s $250,000 deductible can impact insurance premiums, so despite having insurance, it is important to keep claim costs down, and within the City’s deductible. The higher the deductible, the less of an impact on insurers and the less the City is paying to cover the insurer’s costs.

Because the City was insured by OMEX for so many years, it is still vulnerable to future retro-assessments. OMEX was an insurance reciprocal, and as such, it can obtain additional funding from its members after the fact if there is a shortfall in reserves for previous years caused by extraordinary claims experience or other unexpected factors.